How to Decide Which Moving Average to Use

Calculate the simple moving average for the period The EMA needs to start somewhere and the simple moving average is. Frustration among traders is definitely on the riseWith no.

The Exponential Moving Average Ema Indicator Moving Average Exponential Technical Analysis

You sum up N most recent prices and divide the.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-01-7559aba839cc410d8553868da1f1afc3.jpg)

. Where y is the variable such as single-family housing permits t is the current time period such as the current month and n is the number of time periods in the average. The 50 moving average is the standard swing-trading moving average and very popular. Next deduct the exponential moving average of the previous period from the.

The 10-day moving average plotted on an hourly chart is frequently used to guide traders in intraday trading. As its name suggests it is also the simplest one to calculate and understand thats probably the main reason why its the most popular. Some traders use Fibonacci numbers 5.

Just divide 25 by the length of each bar the time frame you are displaying on your chart and you get the number of bars you will use for calculating the moving averages the moving average period. During trends price respects it so well and it also signals trend shifts. In IBM Cognos Analytics - Reporting you can use a prompt to.

Where e is white noise. All you have to do is pick several different periods MAs and plot them on a chart. First calculate a Weighted Moving Average with period n2 and multiply it by 2.

Or clearvars if you want. You could determine the sum of absolute differences for different window sizes and plot it. Calculate the multiplier for weighting the exponential moving average The formula for.

The time frame is 7 or max 10 minThe above set up is for DAY TRADING Only. When calculating the exponential moving average the following three steps are used. Each trader must decide what their purpose is for choosing the type of moving average and what their goal is for using the different lengths on the moving averages.

Y t e t θ 1 e t 1 θ p e t p. A moving average calculates the average of a data set for a specified period. For example the moving average of return quantities at March 2012 with a specified period of two would be calculated by adding the return quantities in February and March and then dividing that sum by two.

Simple moving average is simply the arithmetic average of the last N bars N is the moving average period discussed above. Simply use S21 with a yellow colour E20 with a red colour When yellow comes below the red then buy yellow crosses above the red sell it. The most famous ones are AIC and BIC.

Identify the numbers you want to average. 20 21 period. Then select the number of time periods you wish to apply.

You can easily include MA ribbons in your trading. Firstly decide on the number of the period for the moving average. Erase all existing variables.

A good first bet is to have the -3 dB cutoff frequency at the upper bandlimit of your signal so that no frequency of the signal is attenuated by more than 3 dB. If price action tends to stay below the moving average then it indicates that it is in a DOWNTREND. Finally this formula is used to calculate the current EMA.

The simplest way is to just plot a single moving average on the chart. These criteria will suggest you the optimal lag length p. As an example lets look at the 21-day exponential moving average of the QQQ to see what it is signaling.

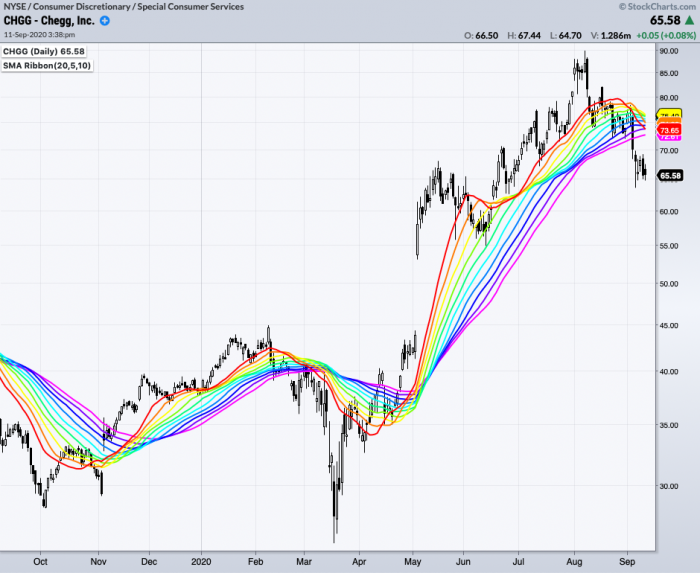

Another popular approach for using Moving Averages as trending indicators is in the trading system called MA ribbons. When a fast moving average such as a 5-day MA crosses over a slow moving average such as a 20-day MA it signals a new uptrend is taking place and is a bullish signal for a trend follower telling them. Maybe some pattern will jump out at you like a knee in the curve.

The most common way to use moving averages is to look for moving average crossovers and this technique has been used by many successful trend followers. 2 n 1. Shorter term moving averages are used to determine the state of the short-term trend.

To be able to determine the length of the moving average ie to decide what is the best p one can use some criteria. Close all figures except those of imtool clear. For a 50-day moving average this would be 2 501 00392.

We also check out Cloudflare. When price action tends to stay above the moving average it signals that price is in a general UPTREND. These approximations were derived here.

The first step is to create a list of the numbers for which the user needs to find the weighted average. Moving Average ribbons uses a series of MAs of different time periods plotted on a chart. Next you must calculate the multiplier for smoothing weighting the EMA which typically follows this formula.

The most common moving average type is simple moving average. Lastly set the percentage value youd like to use for the envelopes. Here are 4 moving averages that are particularly important for swing traders.

A typical setup for in intraday chart would be using the SMA as the longer length moving average to identify support and resistance and using the EMA as the shorter length moving average to. How can we use simple moving average in day trading. So you decide you want to use 25 minutes of history for calculation of moving average on each bar.

The 21 moving average is my preferred choice when it comes to short-term swing trading. Then calculate the multiplying factor based on the number of periods ie. 2 number of observations 1.

Follow the following steps when calculating weighted moving average. In most cases researchers use three- four- or five-month moving averages so that n 3 4 or 5 with the larger the n the smoother the series. Remember EMAs have less lag because they put more weight on recent prices.

The -3 dB cutoff frequency ω c of moving average can be approximated by. Clear the command window. Here we can use the closing prices of ABC stock for the period starting January 1 to January 5.

Next calculate a Weighted Moving Average for period n and subtract it from the one calculated during Step 1. In time series a moving average model is represented as. First decide whether you want to use a simple moving average SMA or exponential moving average EMA.

ω c ω c 2783 N. The most commonly used moving averages are the 50-day moving average which shows the average stock price over the past 10 weeks and the 200-day moving average which does the same for the past 40 weeks. Finally calculate a Weighted Moving Average with a period the square root of n using the data from Step 2.

The Best Moving Average Crossover Combination Moving Average Crossover Best Crossover

Forexuseful The Best Moving Average Settings Are Based On First Choosing The Simple Sma Weighted Wma Or The Ex Moving Average Forex Trading Exponential

0 Response to "How to Decide Which Moving Average to Use"

Post a Comment